January 2015 Debt Update

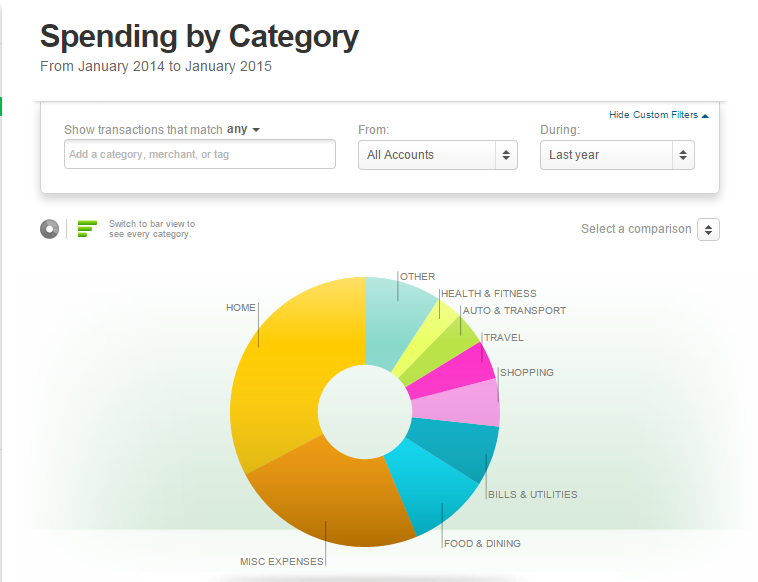

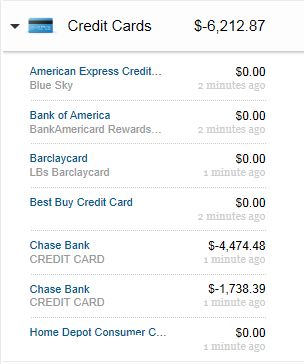

/I know that I should probably wait until the beginning of February to update y'all, because we will be down to our very last credit card by then, but I just am too excited! In December we looked like this:

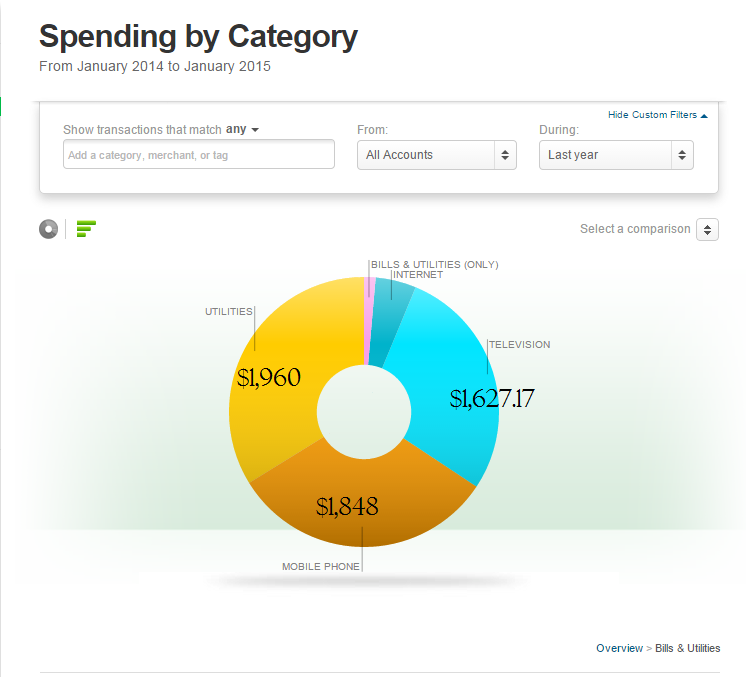

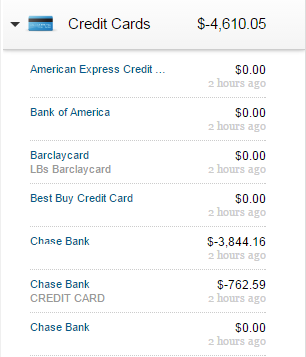

But then we charged $1700 in order to wash clothing... the washer and dryer were well worth it, but man was I worried about the set back. Never fear though, because we paid that off too! Here is where we sit currently:

I cut off the Home Depot line because it shows -3.10 because we returned something and so have a positive? Negative? Balance. Home depot owes me $3.10 and that's all you need to know. :)

The original plan was to use our check in the middle of the month to pay of the $762.59 credit card, but because we are refinancing the house, we wanted to get the $-3,844.16 card down below 80% of the credit limit. The good news is that we are still planning on paying off that $762 sucker at the end of January. The end is in sight... it is so close. We are talking 3 months at most and we will be DONE with credit card debt. Done DUN Done.

I tend to get a bit manic when the end of a goal is in sight: checking the budget everyday, tweaking and making sure that we are going to hit our targets, really cracking down on food spending, ect. I am DESPERATELY trying to not do that, but I am a future tripper, hear me roar. What I need to remember is that we have come this far... paid down this much debt... and we are REALLY doing it! We really are building a financial system that works for our family. It's liberating and empowering.

Addendum: I got asked again about how we are able to do this and stick to it over the course of a year, so I am linking you up again to the mother of all budgeting spreadsheets. It might just be my most prized possession.

When we started FPU we owed

$-17,000 in credit card debt alone!

To have that debt down to

$-4,610.05

Means that in the last year and three months we have paid off

$12,389.95 !!! In DEBT!

How were the holidays to y'all? Did they murder your budget or are you incredible budgeting ninjas? Do share any victories or set backs. This is a safe space!