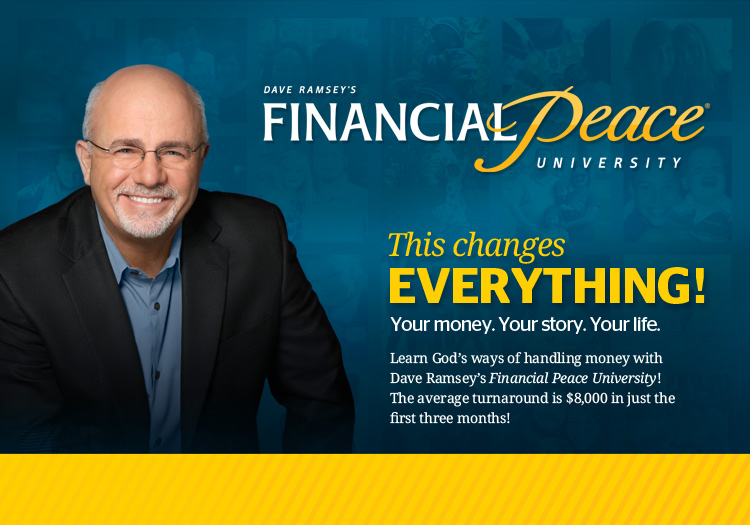

In September 2013, LB and I took the Financial Peace University program by Dave Ramsey. It was life changing. I learned a lot about the choice I have to either Buy More or Just be Thankful? I also got to finally experience the Joy of Giving in the face of a society that pressures me to BUY NOW. I also realized that God wants me to have Financial Peace and even picked up a good Meditation on Money.

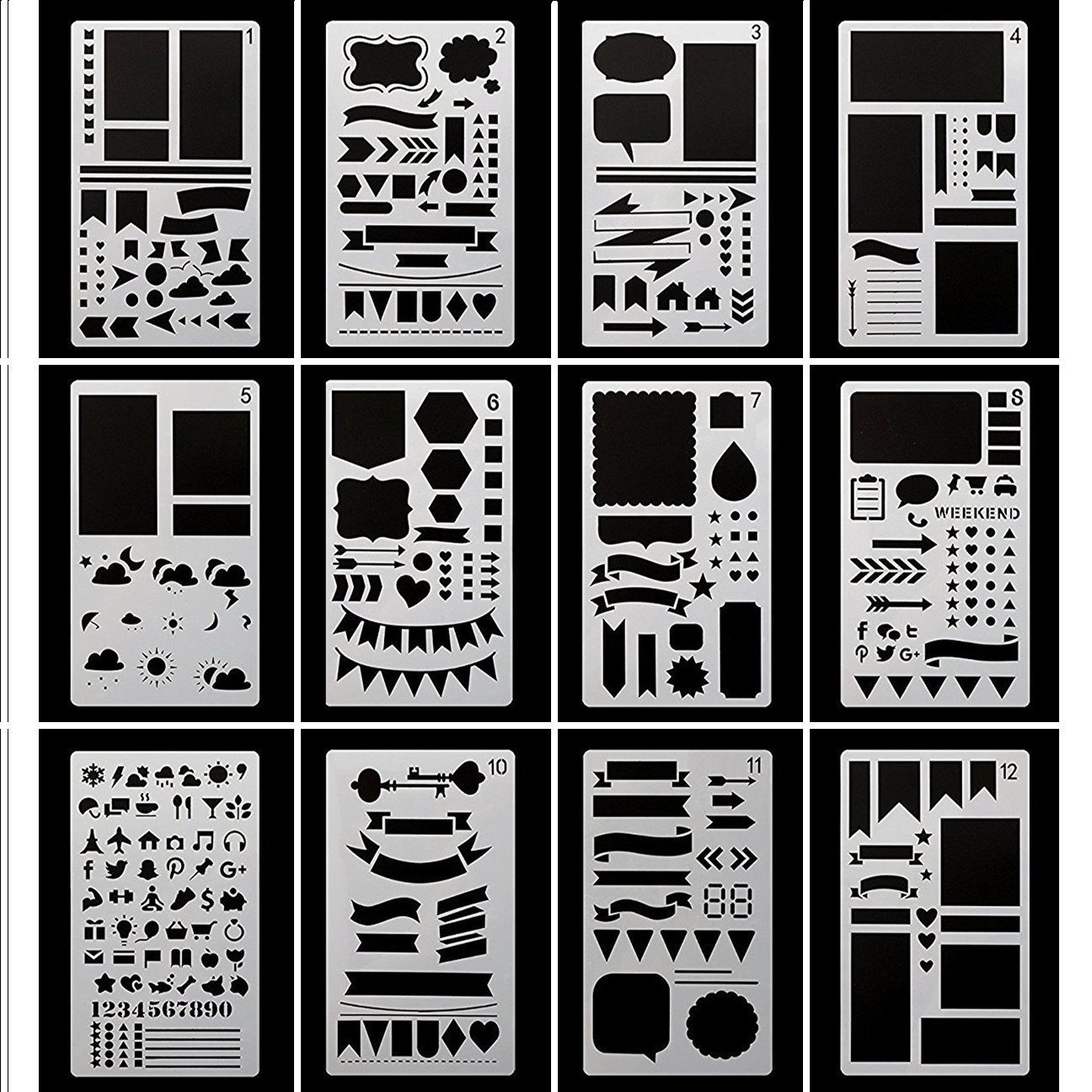

Getting LB on board with our budget was (and still is) a major task, so I shared a few tips for how to get your spouse on board with budgeting. I tweaked and shared with you the MOTHER of all budgeting spreadsheets. Even a year later I look at this thing about 5 days a week and tweak it till it fits our goals. It is what aids us in taking charge of our money! I also have gotten to chose where I give my money away and how I handle the giving portion of my budget.

We also apparently spend a lot on TV: here's where our money went in 2014.

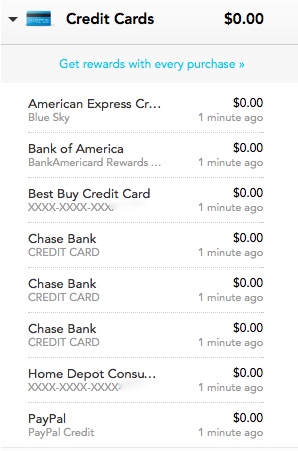

Monthly-ish Debt Updates

The biggest accountability tool for me though have been our monthly debt updates. Clicking through them all will give you a sense of our rollercoaster journey with our budget. I believe that if you don't have a little struggle with your budget, you're not actually trying.

- November 2013

- March 2014

- May 2014

- June 2014

- August 2014

- September 2014

- ONE YEAR IN: October 2014

- We paid off $10,000! December 2014

- January 2015

- May 2015

- June 2015: WE ARE DEBT FREE!

Remember that when we started this debt-free journey we had

$-17,000 in credit card debt alone!