December 2014 Debt Update

/Holy moly schmoley you guys. I haven't been this excited to share a debt update in ages. You see, a crazy thing happened over the last 6 weeks. We paid off the Tires, LB's card, AND got started on the two biggest credit cards we had. HOLY GUACAMOLE!!!!!!!!!!!!!! Since I am so pumped about all this debt progress, we are going to have a money week here on the blog. That's right. In the middle of DECEMBER we are talking budgeting and money and shiz is gonna get real. :) Hold on to your overpriced pants y'all.

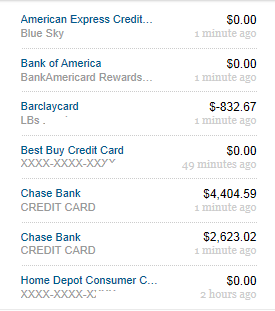

In October this was the scenario:

Plus the tires with a balance of $-775. So our total debt at the end of October (one year in to FPU) was actually

October 2014: $-8,635.28.

Our goal by mid-November/beginning of December was to be at

November goal: $-7027.61!

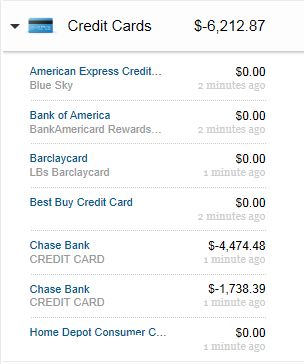

As of this morning this is where we are:

That's right y'all we blew right past that goal by $814! The tires are paid off, LBs card is paid off, Bank of America, Best Buy, Home Depot, Amex! WOOOOOOOOOT! We are for real FINALLY on the last two debts in our debt snowball. THE LAST TWO!

We have passed the $10,000 mark people!

When we started FPU we owed

$-17,000 in credit card debt alone!

To have that debt down to

$-6,212.87

Means that in the last year and two months we have paid off

$10,787.13 !!! In DEBT!

Areas for Improvement:

LB has been kicking butt at work and we are taking most of his increased commissions to make bigger debt payments. We aren't taking all of the extra because well, we're human. I'd like to say that we will take more of his increased commissions to put towards debt, but he is going to start a retirement account with some of it, life insurance with some of the rest, and buying concert tickets and trips and nonsense with the rest. I'd like to knuckle down on the nonsense portion, but we haven't done a TON of treat yo'self stuff in the last year. Don't worry, we aren't going crazy.

Advice

Here is my incredibly non-technical advice from Dave for the holidays:

"Remember: Even at Christmas you must act your wage, you aren't in Congress."

We have put $40 per paycheck in a cash envelope for Christmas since the beginning of the year. Next year we will kick it up to $60 because we've got more kids and babies and friends to buy for... plus about 6 very special birthdays in December as well. It is just a lot. A LOT A LOT. So we're gonna kick our budget up in that category.

What are you and yours doing to make Christmas less financially stressful? (*In my never really all that humble opinion, getting financially strapped is just NOT the point of the holidays.)