2025 Guide: How Gradual Interest Rate Cuts Could Impact Denver’s Housing Market

At House of Bennetts, we know homeownership is about more than design—it’s about understanding the bigger financial picture, too. In 2025, that picture is all about interest rates.

The Federal Reserve has hinted at gradual rate cuts beginning later this year. While that sounds promising for buyers and homeowners, it’s important to understand what this actually means for the Denver housing market—and your home decisions.

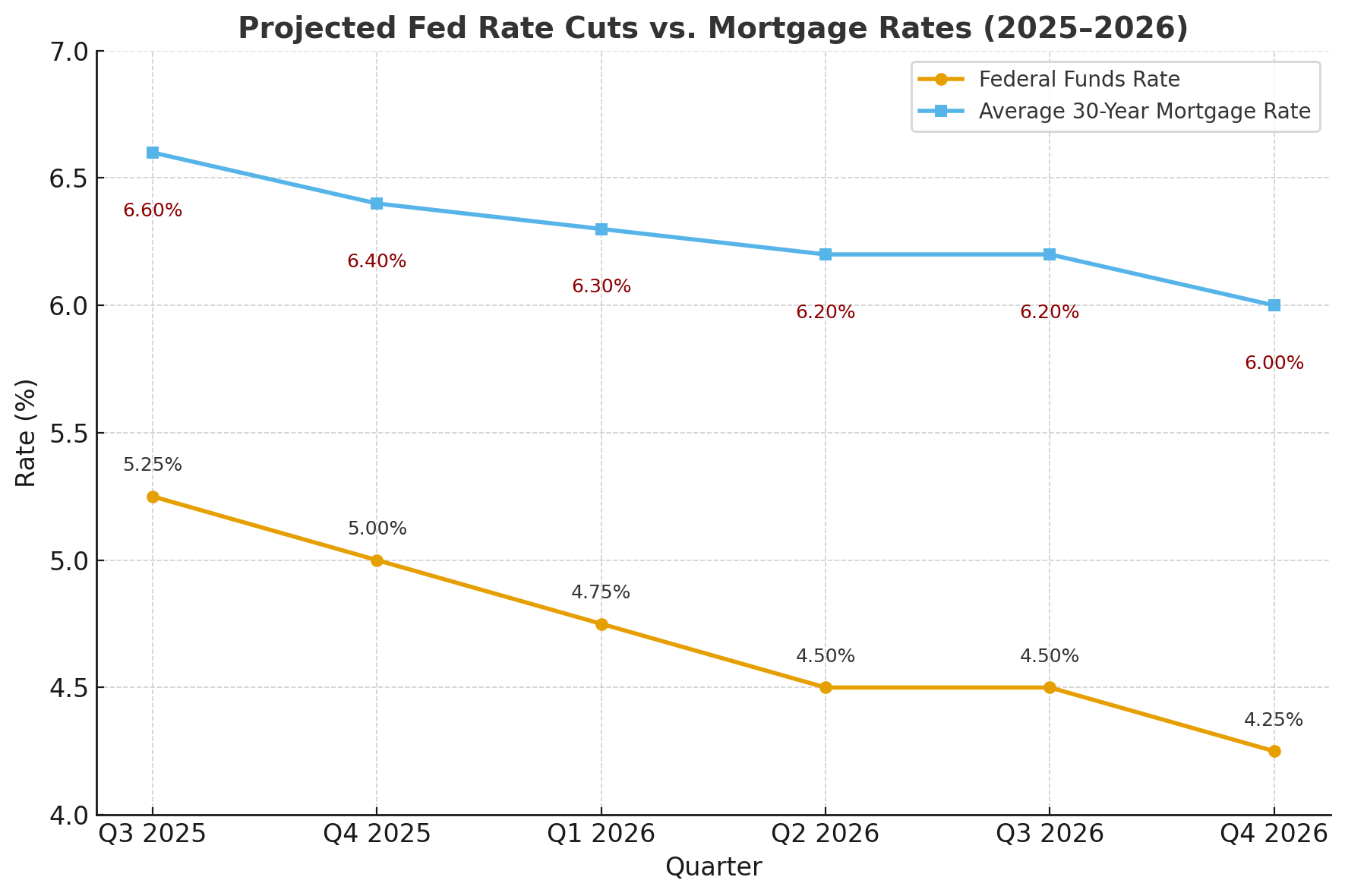

Fed Rate Cuts vs. Mortgage Rates: Why They Don’t Move in Sync

When the Federal Reserve cuts rates, it lowers the cost of borrowing money between banks. But mortgage rates—like the 30-year fixed loan—don’t immediately drop at the same pace.

Fed rate cuts are gradual: Analysts project modest decreases through late 2025 into 2026, not a sharp fall.

Mortgage rates lag: Even with Fed cuts, mortgage rates remain higher, typically floating 1.5–2% above Fed levels. So while the Fed might move from 5.25% to 4.5%, mortgage rates may only dip from the mid-6s to the low-6s.

The takeaway: Don’t expect mortgage rates to collapse overnight. The changes will be incremental.

What Happens When Mortgage Rates Drop—Even a Little

Here’s where it gets interesting: even a small decline in mortgage rates has a big impact on buyer psychology.

Affordability improves: A drop from 6.6% to 6.2% can free up hundreds of dollars monthly, expanding budgets.

More buyers re-enter the market: Those who sat on the sidelines waiting for relief suddenly jump back in.

Competition heats up: More buyers chasing the same inventory often means bidding wars, quicker sales, and less negotiating power for buyers.

For Denver—a market that already feels competitive—this could mean multiple offers on well-styled homes the moment rates shift downward.

How Buyers Should Prepare Now

Get Pre-Approved Early

Know your numbers with current rates. This positions you to act fast when rates edge lower.Work with a Design-Informed Real Estate Team

At House of Bennetts, we help buyers look past surface details, spotting homes with renovation potential so you get more for your money.Act Before the Crowd Rushes In

Sometimes buying before the drop gives you negotiating leverage, since fewer buyers are active.

For Homeowners: Remodel vs. Rebuy

If you already own a home with a low mortgage rate, selling may not be your best option in a high-rate environment. Instead, consider:

Tapping into equity through a HELOC for upgrades.

Redesigning your current space with thoughtful updates that make your home feel brand new—without the higher interest rate burden.

Final Thoughts

Interest rates are shifting slowly, but the ripple effect is powerful. Once mortgage rates dip— even modestly—buyer demand in Denver will spike, creating more competition in the market.

Whether you’re buying, selling, or redesigning, the smartest move is to prepare now. That way, when rates shift, you’re already positioned to win.

Ready to talk strategy? Connect with House of Bennetts for guidance that blends real estate insight with interior design expertise.